- Compliance

- Regulation

- Technology

Latest News

- Data

- ESG

- Resources

- All Resources

- Announcements

- Book Reviews

- Conferences and Events

- Country Guides

- GRIP Extra

- Podcasts

Topics

Latest News

-

Podcast: Masatoshi Honda on navigating the 'lab to market' journey with AI governance

Vlada Gurvich28 min listen

-

AI leaders give perspective on realizing the full potential of AI

Jean Hurley3 min read

-

GRIP Extra: Jane Street denies market manipulation, Google faces EU antitrust complaint over AI overviews

GRIP2 min read

The rule also prohibits the use of any simulated or hypothetical performance that is unaccompanied by a required statement:

“These results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.”

-

CFTC says commodity pool operator mischaracterized risk-management practices

Alleged false or misleading statements were made when describing risk management practices to commodity pool participants and prospects.

Julie DiMauro2 min read

-

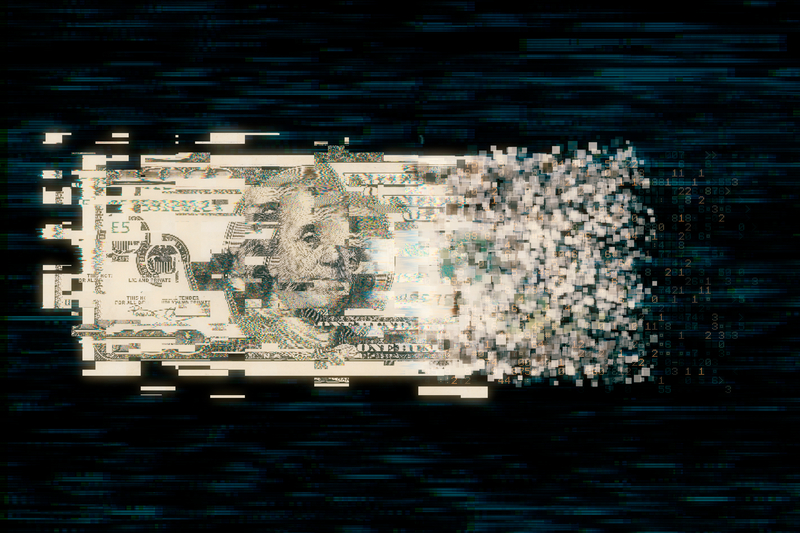

Senate Banking Committee offers up crypto market structure principles

Former CFTC Chair Behnam encouraged committee to support the expansion of the CFTC and SEC's mandate over the crypto market.

Julie DiMauro2 min read

-

CFTC's Johnson speaks of AI tools enhancing compliance, surveillance

Johnson said firms are leveraging AI to enhance their compliance and monitoring capabilities and meet regulatory mandates.

Julie DiMauro3 min read

-

SEC and CFTC extend Form PF compliance dates again

The decision came despite “grave concerns” from outgoing CFTC Commissioner Kristin N. Johnson.

Alexander Barzacanos2 min read

-

Russian crypto payments founder charged with sanctions evasion

The case highlights the urgent need for stablecoin regulation.

Alexander Barzacanos2 min read

-

GRIP Extra: CFTC nominee Quintenz quizzed by senators, FDA to use AI for drug approvals

Our in-brief roundup of notable stories from last week.

GRIP2 min read

-

Blockchain for good: Insights from the 2025 Grunin Conference on law and innovation

Legal experts examined how blockchain technologies are challenging traditional regulatory models and redefining governance.

Vlada Gurvich4 min read

-

GRIP Extra: Ex Goldman partner sentenced, Republicans to limit state AI regulation

Our in-brief roundup also includes China's new crypto ownership restrictions, Trump's tariffs, and a multimillion dollar CIRO fine.

GRIP1 min read